Managing debt can feel overwhelming, especially when it comes to unsecured debt like credit cards and retail store accounts. With rising inflation and the cost of living continuously increasing, many people are finding themselves buried under mounting bills. If you’re struggling to keep up with payments, a Debt Management Program (DMP) offered by a non-profit […]

Continue ReadingTag: debt management

How To Start Digging Your Way Out Of Debt

Debt can feel like a never-ending weight, pressing down on every aspect of your life. When you’re in deep, it might seem like the road to financial freedom is out of reach. But no matter how overwhelmed you feel, there’s always a way forward. Today, let’s take a fresh approach by focusing on the first […]

Continue ReadingHow Many Credit Cards Should You Really Have Open At One Time?

Credit cards are a staple of modern financial life, offering convenience, rewards, and the opportunity to build credit. But how many is too many? The answer isn’t the same for everyone. Understanding the balance between maintaining healthy credit use, and avoiding potential debt pitfalls is essential. This blog will explore the average number of credit […]

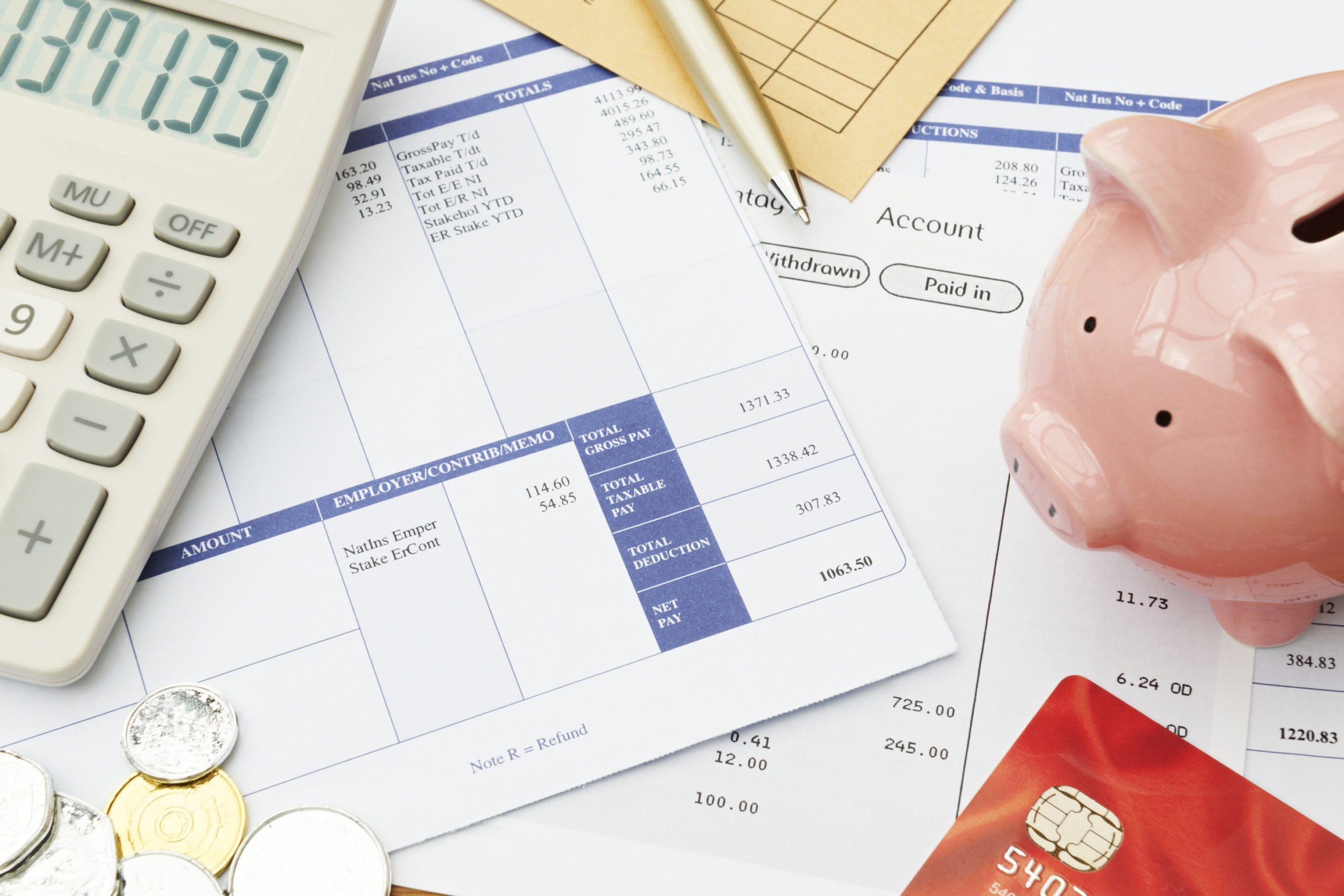

Continue ReadingThe Hidden Costs of Debt: How Interest Rates and Fees Can Add Up

Debt can be a useful tool for achieving your financial goals, but it comes with hidden costs that can quickly spiral out of control. Understanding these costs—such as interest rates, late fees, and other charges—can help you manage your debt more effectively and save money in the long run. In this blog post, we’ll explore […]

Continue ReadingWhat To Do If You’re Facing Wage Garnishment

Wage garnishment can be a stressful and overwhelming experience, especially if you’re already dealing with debt. The idea of losing a portion of your paycheck before it even reaches your bank account may leave you wondering how you’ll make ends meet. Understanding the wage garnishment process, how it impacts your finances, and knowing your options […]

Continue ReadingHow To Use Windfalls Wisely: Paying Down Debt Versus Saving For The Future

Receiving a financial windfall, whether from a tax refund, a bonus at work, or even an unexpected inheritance, can feel like a major relief. However, deciding how to best use that extra money can be tricky. Should you focus on paying down debt or stash it away for future financial goals? The right answer depends […]

Continue ReadingHow To Understand And Get Help With Your Credit Card Bills

Managing credit card bills can be overwhelming, especially when balances start to grow. However, understanding your credit card bills and knowing where to get help can make a big difference in your financial well-being. Here’s an in-depth guide to help you navigate your credit card statements and explore your options for assistance. Let’s Take A […]

Continue ReadingDealing With Debt Collectors: Your Rights And Best Practices

Facing debt can be daunting, especially when debt collectors come calling. Many people feel intimidated and unsure of their rights when dealing with these agencies. At our non-profit credit counseling agency, we believe that knowledge is power. Here’s a comprehensive guide to help you understand your rights and best practices when dealing with debt collectors. […]

Continue ReadingExploring Side Hustles To Accelerate Your Debt Repayment Journey

In today’s fast-paced world, many individuals and families find themselves grappling with debt. While budgeting and careful financial planning are essential, sometimes, they might not be enough to tackle debt. This is where side hustles come into play. By generating extra income through various side hustles, you can expedite your debt repayment journey and achieve […]

Continue ReadingMistakes To Avoid During Debt Repayment

Debt repayment can be a challenging but rewarding journey, offering a path to financial freedom and peace of mind. However, navigating the road to being debt-free can be complex, and there are common pitfalls that can hinder your progress. To help you stay on track, let’s look at some of the most common mistakes people […]

Continue Reading