Managing debt can feel overwhelming, especially when it comes to unsecured debt like credit cards and retail store accounts. With rising inflation and the cost of living continuously increasing, many people are finding themselves buried under mounting bills. If you’re struggling to keep up with payments, a Debt Management Program (DMP) offered by a non-profit […]

Continue ReadingTag: Credit Counseling

How To Start Digging Your Way Out Of Debt

Debt can feel like a never-ending weight, pressing down on every aspect of your life. When you’re in deep, it might seem like the road to financial freedom is out of reach. But no matter how overwhelmed you feel, there’s always a way forward. Today, let’s take a fresh approach by focusing on the first […]

Continue ReadingAdvantageCCS Recognized As One Of The Best Credit Counseling Services

At Advantage Credit Counseling Service (AdvantageCCS), we have dedicated over 50 years to helping individuals and families take control of their finances, reduce debt, and achieve lasting financial stability. Today, we are very excited to share some incredible news: we’ve been recognized by TopConsumerReviews.com as one of the Best Credit Counseling Services for 2025! What […]

Continue ReadingHow Many Credit Cards Should You Really Have Open At One Time?

Credit cards are a staple of modern financial life, offering convenience, rewards, and the opportunity to build credit. But how many is too many? The answer isn’t the same for everyone. Understanding the balance between maintaining healthy credit use, and avoiding potential debt pitfalls is essential. This blog will explore the average number of credit […]

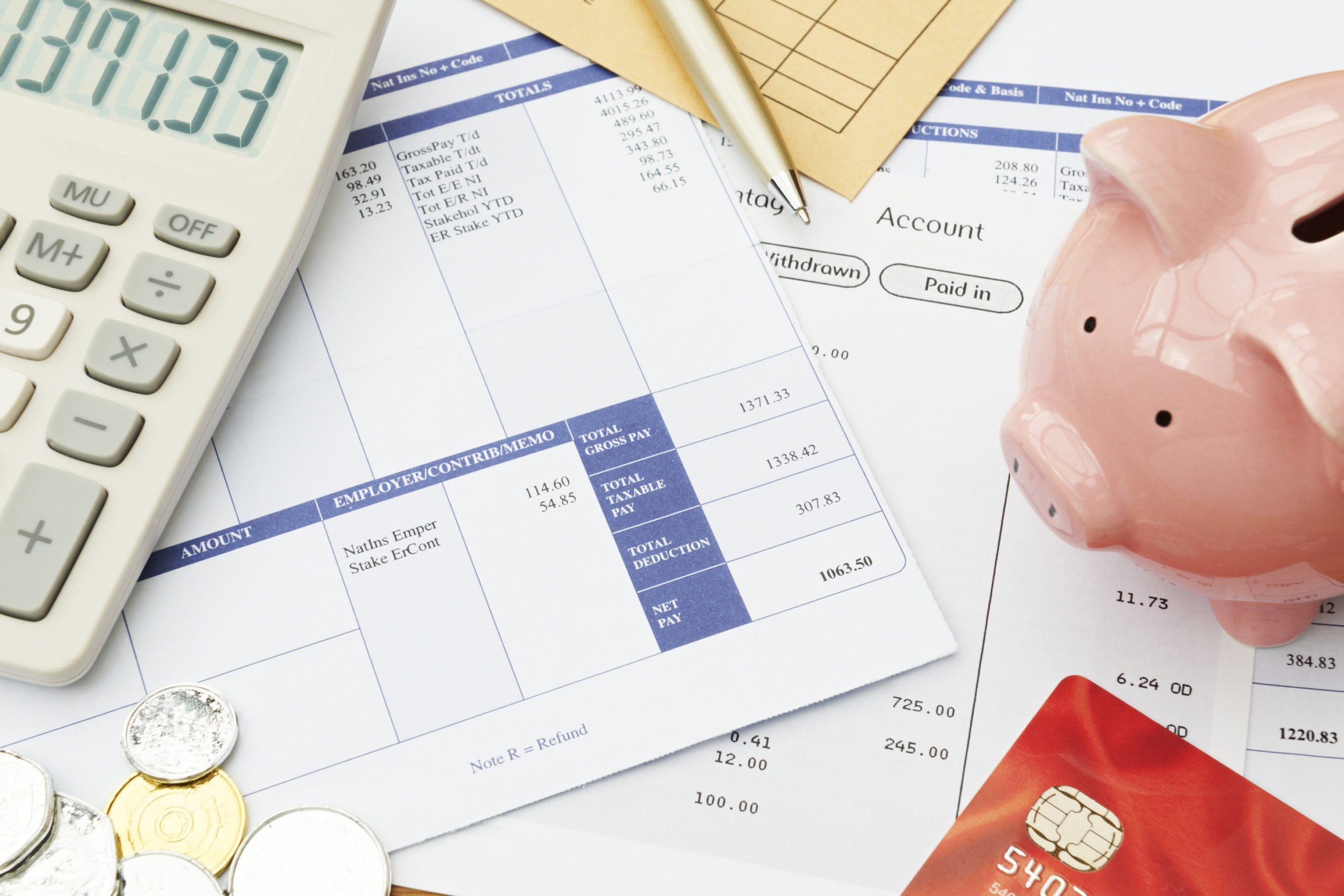

Continue ReadingThe Hidden Costs of Debt: How Interest Rates and Fees Can Add Up

Debt can be a useful tool for achieving your financial goals, but it comes with hidden costs that can quickly spiral out of control. Understanding these costs—such as interest rates, late fees, and other charges—can help you manage your debt more effectively and save money in the long run. In this blog post, we’ll explore […]

Continue ReadingWhat To Do If You’re Facing Wage Garnishment

Wage garnishment can be a stressful and overwhelming experience, especially if you’re already dealing with debt. The idea of losing a portion of your paycheck before it even reaches your bank account may leave you wondering how you’ll make ends meet. Understanding the wage garnishment process, how it impacts your finances, and knowing your options […]

Continue ReadingHow To Use Windfalls Wisely: Paying Down Debt Versus Saving For The Future

Receiving a financial windfall, whether from a tax refund, a bonus at work, or even an unexpected inheritance, can feel like a major relief. However, deciding how to best use that extra money can be tricky. Should you focus on paying down debt or stash it away for future financial goals? The right answer depends […]

Continue ReadingHow To Understand And Get Help With Your Credit Card Bills

Managing credit card bills can be overwhelming, especially when balances start to grow. However, understanding your credit card bills and knowing where to get help can make a big difference in your financial well-being. Here’s an in-depth guide to help you navigate your credit card statements and explore your options for assistance. Let’s Take A […]

Continue ReadingHow To Stay Out Of Debt Once You’ve Paid It Off

Congratulations! Paying off your debt is a significant accomplishment that requires dedication, discipline, and perseverance. But now that you’ve achieved this milestone, the next challenge is staying out of debt for good. It’s easy to slip back into old habits, but with some proactive steps, you can maintain your financial freedom and avoid the debt […]

Continue ReadingThe Rising Tide Of Household Debt: How A Debt Management Program Can Be Your Lifeline

Indeed, financial stability can often feel like an elusive goal. For many American households, debt is a significant obstacle standing in the way of achieving financial peace. According to recent data, the average American household debt has reached staggering heights, with credit card debt, student loans, and mortgages forming the bulk of this financial burden. […]

Continue Reading