Managing credit card bills can be overwhelming, especially when balances start to grow. However, understanding your credit card bills and knowing where to get help can make a big difference in your financial well-being. Here’s an in-depth guide to help you navigate your credit card statements and explore your options for assistance. Let’s Take A […]

Continue ReadingTag: Credit Score

How To Develop A Healthy Relationship With Credit Cards

Credit cards are an important part of everyday life. They offer convenience, security, and a range of benefits. However, if not managed properly, credit cards can lead to overwhelming debt and financial stress. Developing a healthy relationship with credit cards is essential to ensure that you harness their advantages while avoiding the pitfalls. Let’s take […]

Continue ReadingUnderstanding The Ripple Effect: How A Business Loan Can Impact Your Personal Credit

Securing capital is often essential for growth and expansion in the dynamic business world. Business loans provide entrepreneurs with the financial backing they need to invest in their ventures, hire staff, and upgrade equipment. However, what many business owners fail to realize is that their business and personal financial spheres are interconnected. Taking out a […]

Continue ReadingMajor Benefits Of Having A Good Credit History

When it comes to managing personal finances, maintaining a good credit history is crucial. A strong credit history and a high credit score can open the doors to numerous financial opportunities. From lower interest rates to increased borrowing power, a positive history offers a range of benefits that can make a significant difference in one’s […]

Continue ReadingHow Many Points Does Your Credit Score Drop If You’re Late On A Payment?

A credit score is a numerical rating that represents a person’s creditworthiness. It measures how likely someone is to repay their debts on time based on their credit history. Credit scores are typically calculated using a mathematical formula that considers various factors, including payment history, the amount of debt owed, length of credit history, types […]

Continue Reading5 Helpful Tips On How To Use Credit Cards Responsibly

Some refuse to use credit cards, thinking that if they don’t use them, they won’t get into a difficult financial situation like debt. The truth, however, is that credit cards can be powerful tools if they are correctly used. They can help you build up your creditworthiness and increase your credit score if you use […]

Continue Reading10 Bad Habits Or Decisions That Can Decrease Your Credit Score

A credit score is a measure of the creditworthiness of a person. The higher the number, the more creditworthy a person is. It’s possible for people to achieve scores in the 800s, which can help them get loans at lower interest rates, qualify for better insurance rates, and make it easier to rent an apartment […]

Continue ReadingLearn How To Get Your 3 Credit Reports For Free

If you have ever applied for a loan or a credit card, you are probably aware of the importance of your credit report and credit score. The information a credit report contains tells lenders whether you are a “credit risk” or not. It can also determine what interest rates you will be offered and other […]

Continue ReadingAdvantage CCS’s Special Interview With BadCredit.org

When Adam West from BadCredit.org reached out to me via LinkedIn and email about doing an interview to explain what Advantage CCS is all about, who we can help, and what we offer, I jumped at the chance. I’ve shared BadCredit’s blog posts and social media posts before because they offer some amazing content and […]

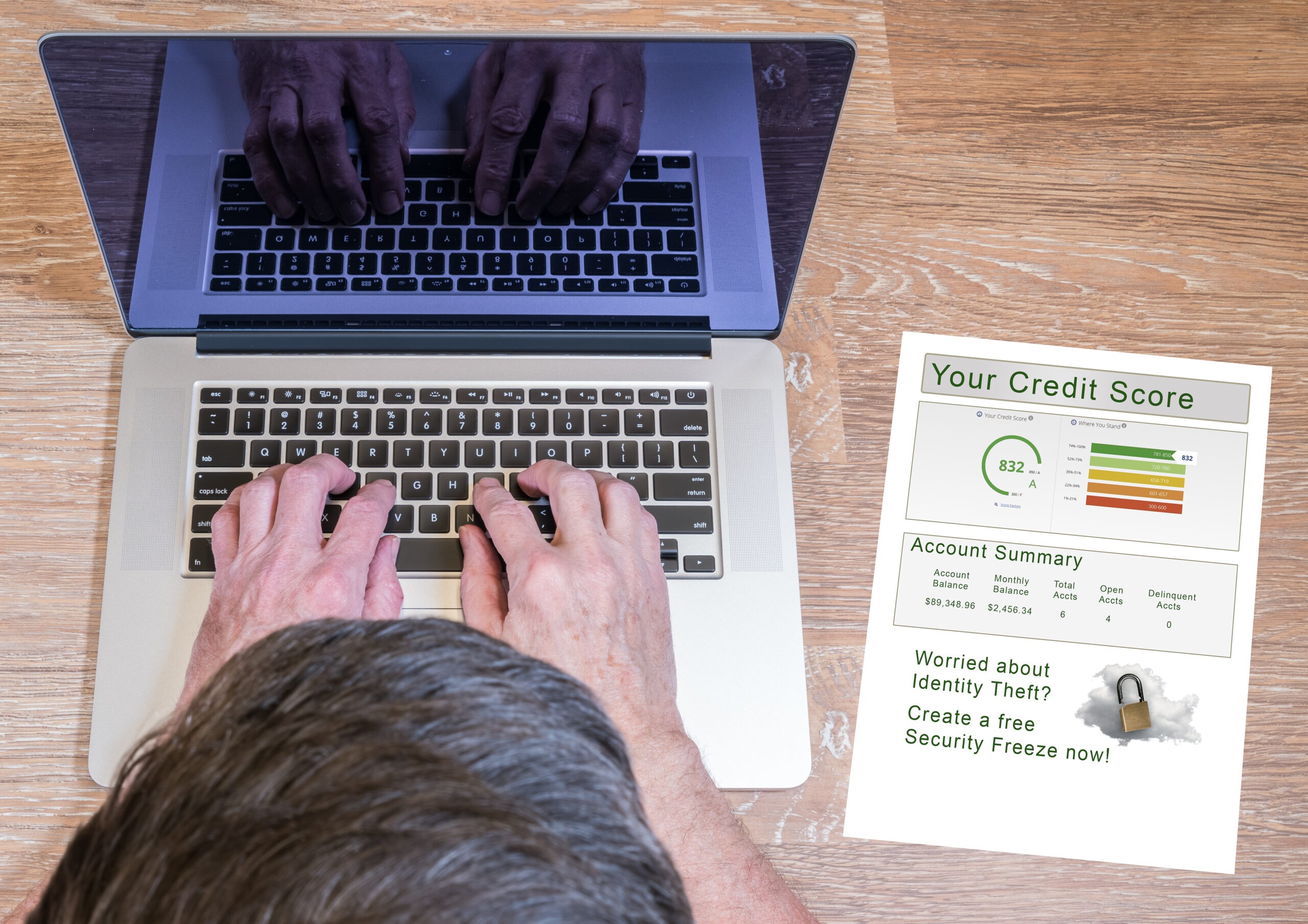

Continue ReadingWhat Is A Good Credit Score And Why Does It Matter?

A credit score is a numerical value between 300-850 that someone is assigned to show a potential lender how likely one is to honor their debts. The higher the credit score is, the more trustworthy they appear to the lender. This is also called Creditworthiness in the lending industry. But what is a good credit […]

Continue Reading