Credit cards are widely misunderstood financial tools. To some, they’re a source of unlimited funds that later turn out to be problematic when the bills are due. To others, though, they’re forbidden objects that must never be touched, stopping these fearful individuals from building credit or making necessary purchases. In truth, a credit card is […]

Continue ReadingTag: financial tools

How To Make S.M.A.R.T. Financial Goals

Goals are dreams or wishes that could come true – if you work really hard at them. If your financial goals are specific enough, they will motivate you to balance your spending and savings in order to reach your objectives. If you don’t set financial goals, you will find yourself saying “I wish I had…” later […]

Continue ReadingHow Workplace Financial Wellness Programs Can Help

The 2018 PricewaterhouseCoopers (PwC) Employee Financial Wellness Survey found that 54% of employees are stressed about their finances. According to a Country Financial Security Index survey, 67% of Americans worry about their financial future, credit card debt last year hit a record high, and 44% of people can’t come up with $450 to cover an […]

Continue Reading15 Books to Read this Summer about Money and Debt

Regardless of how one feels about money, it is hard to argue against its influence on people’s lives. This is never more true than with those struggling with finances and debt. There is no shortage of advice on managing money and it can be overwhelming at times, but some financial books have managed to rise […]

Continue Reading12 Things You Wish Your Parents Told You About Money

Managing your finances properly can be a tricky business, especially if a person is fresh out of high school or college. He or she might have a new job and a checking account. They might think they are ready to take on the world, but that new income might suffer as a result of improper […]

Continue ReadingWhen Should You Start Collecting Social Security Benefits

Collecting Social Security Benefits For Retirees – The age at which an individual should begin collecting Social Security depends on his or her unique circumstances. The longer an individual can delay collecting, the higher the monthly benefit amount will be. Ultimately, the total amount collected will probably be about the same. Those who start collecting […]

Continue ReadingLearn How To Budget Your Expenses The Right Way

The word “budget” gets tossed around a lot, from the mom who tells her teen that a new gaming system is not “in the budget,” to the school officials who moan that “the annual budget was cut”. How to budget effectively, however, remains a mystery to many people. Their financial records are a bewildering jumble of […]

Continue ReadingThe Best Websites and Apps for Budgeting

It’s no secret that budgeting can be boring…if you let it. We’re here to show you the best ways to go about setting up a budget and how to easily maintain and stick to that budget. We’re also going to list some of the best budgeting resources out there today to help you accomplish all […]

Continue Reading10 Shocking Myths about Budgeting

Budgeting has a sort of stigma attached to it. If you ask a friend whether or not they have a budget, chances are they’ll say no and give you a reason why. Some people think it’s too time-consuming to set one up while others think it limits what they can and cannot do in their […]

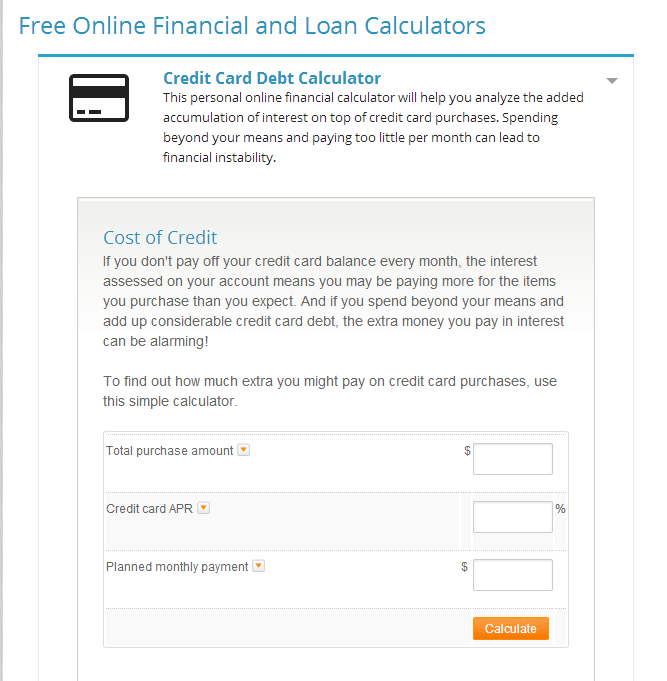

Continue ReadingCredit Card Debt Calculator and How to Pay Off Debt

You can always count on interest accumulating if you carry a balance every month on your credit cards. Sure, you may still have a month or two of “free interest” left on that credit card you signed up for, but when that promotion ends, what happens then? You get hit with some charges and fees […]

Continue Reading