Creating a budget is generally considered to NOT be a very fun task, but that may be even more true when trying to budget as a single parent. It may be especially difficult if you’re a single mom or dad trying to support your household and children on a fixed income with little to no […]

Continue ReadingAuthor: Lauralynn

Fair Credit Reporting Improvement Act of 2014

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, distribution, and use of consumer credit information. Along with the Fair Debt Collection Practices Act (FDCPA), FCRA forms the base of consumer credit rights in the United States. It was originally passed in 1970, and it’s enforced by the Federal Trade Commission. This seemingly outdated Act may receive […]

Continue ReadingHow to Use the Debt Snowball Method

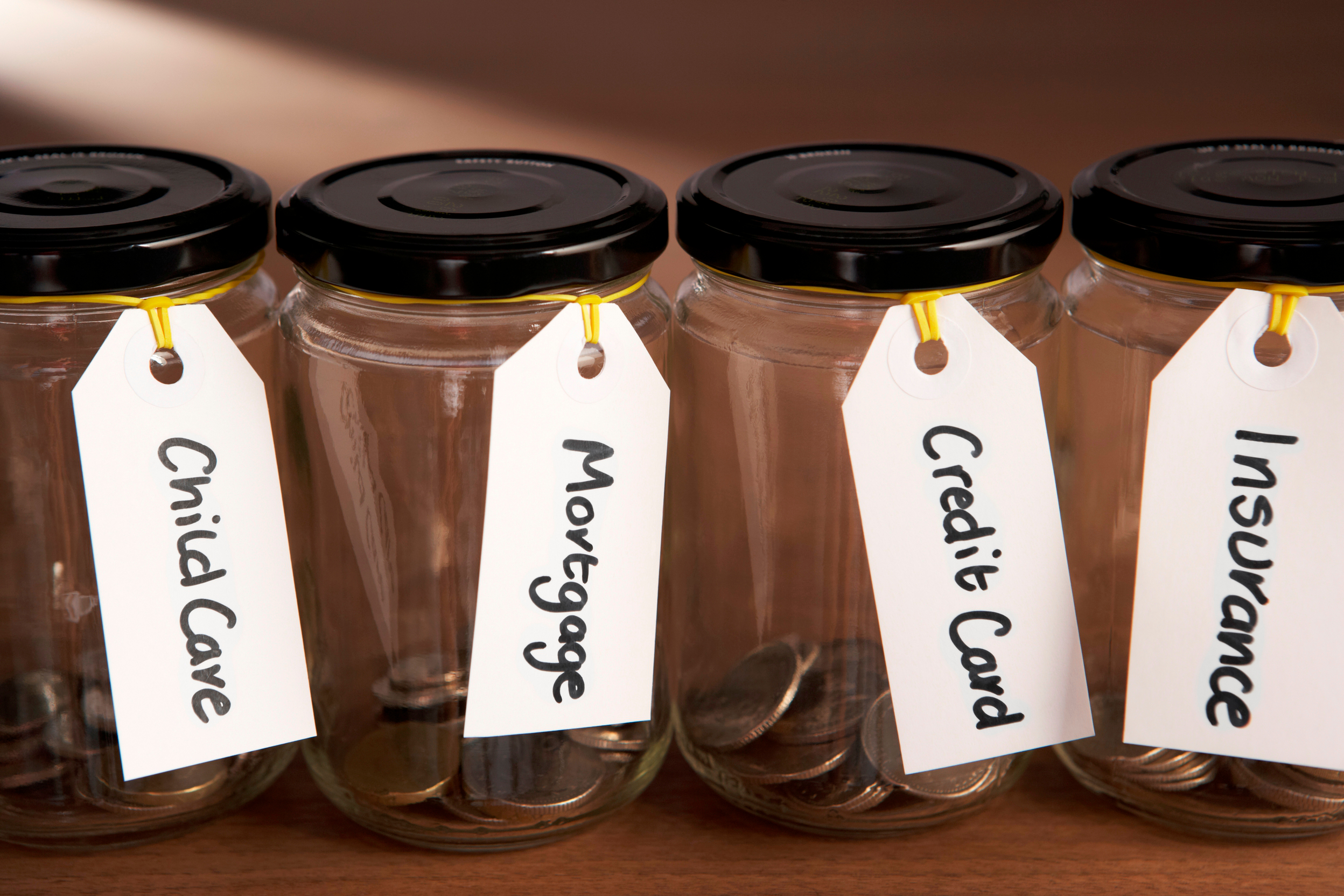

If you owe money on multiple credit cards, you may be wondering where to focus your efforts and which card to pay off first. Some financial experts believe, when attempting to manage your debt, you should aim to eliminate the card with the highest interest rate first. While this method is very effective, if the […]

Continue ReadingHow to Enjoy the Weekend for FREE

The weekend is almost here, and you are probably looking for something fun to do. Maybe it’s a backyard party, an art gallery crawl, a wine mixer, or even hitting up your favorite theme park. If you happen to be on a tight budget right now and trying to get your personal finances in order, […]

Continue Reading10 Ways to Save Money in College

Have you ever heard anyone say “I’m as broke as a college student”? There’s a good reason for that saying. Most college students aren’t earning enough money to make ends meet, or they spend what money they do have rather poorly. We’re going to show you 10 different ways to save money in college: 1. […]

Continue ReadingWhen Should You Consider Bankruptcy?

How do you know when it is time to file for bankruptcy? There are several reasons why a person would consider declaring bankruptcy. Here are some of the reasons why you need to consider filing for bankruptcy: Do you pay only the minimum payment on your monthly bills? Are you several months behind on your payments? Do you have […]

Continue ReadingRegain Financial Freedom with Debt Management

Whether you find yourself struggling month to month to pay your bills, fear the looming calls from debt collectors or even worry about potentially losing your home or car, it is important to recognize that there is hope. Thousands of Americans face the financial crisis of seemingly overwhelming debt. With the aid of debt management […]

Continue ReadingStudent Loan Debt Calculator

Before you decide which college you’ll attend, it’s important to understand where the money is coming from to pay for your college tuition, food, books, room and board, etc. Determine how much college will cost you by taking advantage of free online tools and calculators. You or your parents may have already started a college […]

Continue ReadingDebt Consolidation Tips

We all know that debt can be overwhelming and even cause problems among family members due to intense stress and many other factors. If you are looking for ways to get out of debt, then chances are you’ve heard about debt consolidation or debt management plans. We’re going to share some debt consolidation tips with […]

Continue ReadingWhat is the best debt to credit ratio?

We get asked this question a lot by our current clients and potential clients: “What is the best debt to credit ratio?” First, we must explain what a debt to credit ratio is. To put it in layman’s terms, it is how much you owe versus your total available credit limit. A debt to credit […]

Continue Reading