As the year wraps up (pun intended), we can look ahead to next year and wonder what our finances might look like in 2022. It’s no secret that inflation is taking off right now, and prices are climbing higher and higher for our everyday needs.

So, how does a person reduce their monthly expenses when things like inflation and supply shortages cause the price of everything to increase? The first thing to do is figure out where your budget isn’t working. Is it your lack of savings? Your income? How about the unnecessary expenses and purchases?

Reduce your monthly expenses in 2022 by budgeting correctly, saving money for future needs, and spending wisely. It’s easy to become overwhelmed by all the aspects of budgeting, but it doesn’t have to be complicated.

The budget is, simply put, a way to monitor spending and stay on track financially. A budget allows one to see how much money they’re taking in (income) versus how much money is going out (expenses). This all adds up to their bottom line: their net worth.

Creating a budget is the FIRST step to taking control of your finances, and it’s not as hard as people may think.

Get Started With a Free Debt Analysis

We make it easy on mobile or desktop. FREE with no obligations.

Here are three tips to help you get started:

1) Start with fixed expenses –

This would include rent or mortgage, car payments, and insurance premiums. These are the items one knows they have to pay each month, so it’s essential to make sure they are included in the budget.

2) Next, look at variable expenses –

This would include things like groceries, entertainment, and gas. These expenses can vary from month to month, so it’s essential to be realistic when creating your budget.

3) Finally, do NOT forget to save –

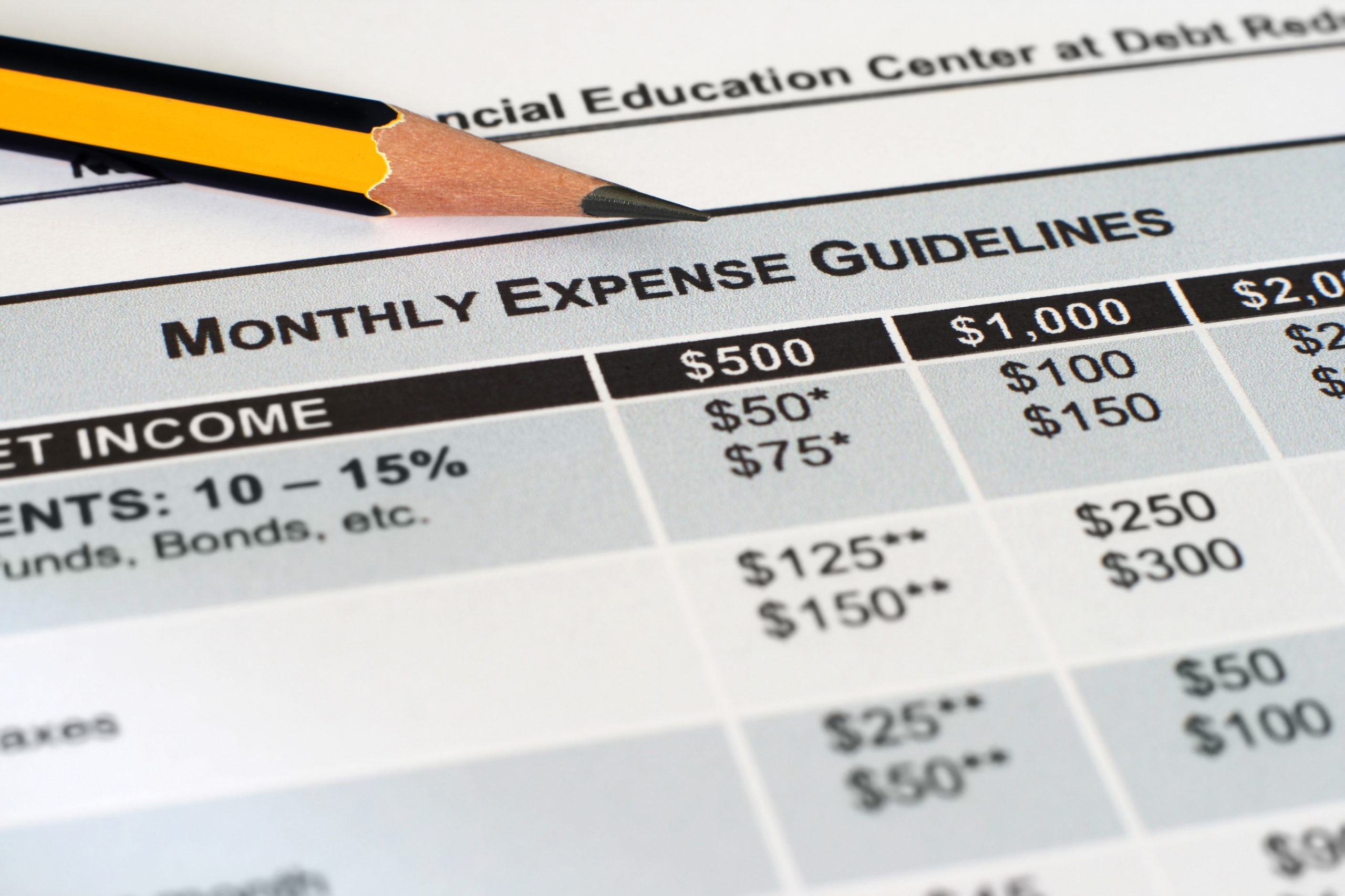

It is essential to have a savings account to help cover unexpected expenses or save for future goals. Try to shoot for at least 10% of the income each month.

If you’re having trouble sticking to your budget, there are a few things you can do to help reach your monthly financial goals. For starters, try creating a budget with monthly cash flow charts. This will help you visualize the money that comes in and out of your accounts every month.

One simple rule would be to save 50% of monthly income for future purposes.

A second rule could be to save all monthly leftover income.

The third rule is to allocate monthly leftover income for investments.

The fourth rule: invest monthly income and check on it every six months.

When you reduce your monthly expenses, keep the following things in mind:

– Your monthly expenses should not exceed 50% of your monthly income.

– Save 20% of your monthly income in a high-yield savings account.

– Avoid not paying monthly expenses on time, such as rent, installment loans, credit cards, etc. Monthly installment loans should be paid off in four months maximum.

– Create cash flow charts to help visualize your monthly income and expenses.

When creating or modifying your budget, it’s important to be realistic. If you’re not able to stick to a specific budget, it’s likely not going to work for you. Try adjusting your budget until it fits your lifestyle and current financial situation.

Also, make sure to check your free credit report for free once a year. Doing this will help you monitor any fraudulent activity or errors in your credit reports.

If you’re having trouble getting started on your budget, free consumer credit counseling can help. These counseling services are offered through a variety of organizations, but it’s best practice to seek the help of a Non-Profit credit counseling agency. They can help you create a budget that works for you and provide advice on sticking to it. Being prepared for financial emergencies is the best way to avoid debt.

The most important thing to remember is that your budget should fit your lifestyle and current financial situation. If it’s not working for you, make the necessary changes until it does. Start small if you need to, but remember: Your budget will help take care of you in the long run!

In conclusion, reducing monthly expenses in 2022 can be a daunting task, but it is achievable if done correctly. Try to take a holistic and individualized approach, and always be sure to stay realistic with your budget and goals. Additionally, credit counseling services can be an excellent resource for those looking for help organizing their finances. With a little bit of patience and perseverance, you can get your monthly expenses under control and feel a little bit better each month.