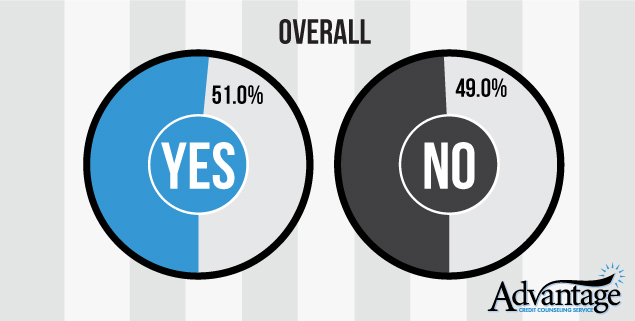

A survey we conducted showed that 51% of Americans across the country have a savings plan versus 49% who do not.

Positive and negative responses to the question: “Do you have a savings plan?”

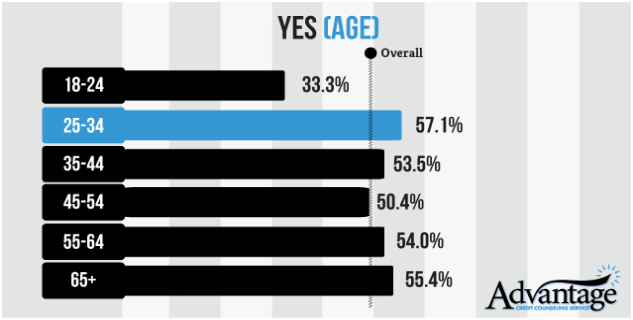

Age Differences Were a Major Factor

Although average responses were almost evenly divided, age played a major factor in whether an individual had a savings plan. Only 33.3% of those aged 18-24 had a savings plan. The other age groups hovered in the 50s on the percentile range with the highest group (25-34 years) at 57.1% and the lowest group (45-54 years) at 50.3%. This chart shows that even as people near retirement, they are not more likely to have a personal savings plan.

Get Started With a Free Debt Analysis

We make it easy on mobile or desktop. FREE with no obligations.

Positive responses, sorted by age

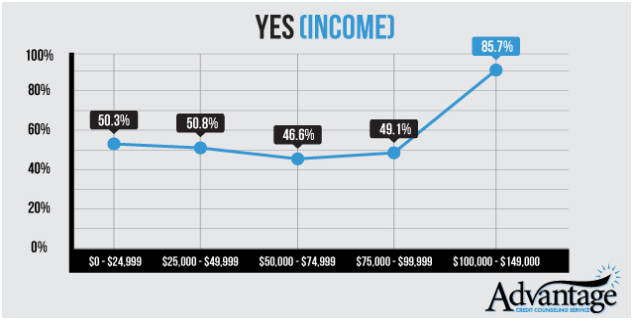

Big Earners Save the Most

The only other significant category in the survey was income. Although responses were fairly even across the first 4 income groups (ranging from $0-$99,999), there was a major jump in the last measured group ($100,000-$149,999). While the first groups hovered slightly under 51%, the last group jumped to 85.7%, indicating that the vast majority of higher earners have a personal savings plan in place.

Positive answers, sorted by income

Other Factors Relatively Even

While there were slight differences in male to female (52.6% to 49.6%), region (Northeast 45.8%; South 50.9%; West 52.9%; Midwest 54.2%), and urban density (suburban 48.3%; rural 49.7%; urban 54.3%), these differences were not significant. Except in the cases of early adulthood and high income, the country seems almost perfectly split between having and not having a savings plan.

What Happens Without a Savings Plan

While half of the country has a savings plan, this is still a failing grade. At best, not having a financial plan means that, after normal expenses, your remaining money sits idle when you could be generating more wealth.

However, forgoing a personal savings plan often indicates that a person doesn’t keep track of their finances. In these cases, people finding themselves spending all or most of their money every month, resorting to credit cards, and wracking up debt before they have a chance to pay it off. Eventually, this leads to having their paychecks already spoken fore before they even receive them.

In the event of an emergency, people without a savings plan will have to struggle to find ways to cover new or sudden expenses. Down the line in retirement, people without a savings plan may not be able to maintain their former lifestyle, particularly if their Social Security checks have to pay down old debts.

What Type of Savings Plan Should You Have?

The very least that any working adult should have is an emergency fund. Calculate the expenses you will need to cover 3 to 4 months of expenses (rent/mortgage payments, food, bills, etc.). In case you have a sudden medical emergency that insurance doesn’t cover, a car breaks down, you are laid off from work, or something just comes up, you will be able to have a financial cushion to tide you over for a few months until you are able to find a solution. This fund can be kept in a savings account so it can be withdrawn easily while still earning more interest than in a checking account.

If you have already built up an adequate emergency fund, personal savings can cover other areas. Starting a retirement fund, even for younger workers, is a great way to put surplus income to work. An IRA or 401(k) are some of the most popular ways to put money away for later. However, these types of retirement funds are a commitment. You can withdraw your money before the collection date, but there may be heavy fees attached to it, and it will be counted as extra income that you will have to pay taxes on.

Before starting a retirement fund, decide whether you will need this money for something else in the years to come. For example, you may have debt or student loans that should be paid down first. It’s also better to start saving earlier rather than waiting until you are nearing retirement. Because earlier savings will compound more interest over the years, people who start saving earlier will need to invest less than those who start later to get the same final amount.

For free financial counseling and to develop a personal savings plan, contact the credit counselors at AdvantageCCS.