Your debt to income ratio (DTI) is a key component of how healthy your credit is. It has no effect on your actual credit score, but lenders take it into consideration when it comes to applying for a mortgage or other major loans.

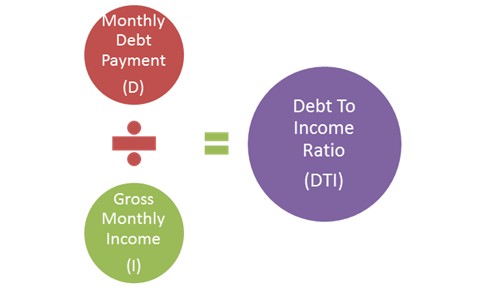

Lenders use the DTI ratio to help them to calculate how much additional debt you can handle and whether or not you are going to be a credit risk for them. The ratio is reached by dividing your total monthly debt payments by what you earn per month, then multiply that number by 100 to get your percentage (debt ÷ income x 100 = DTI).

Your debt payments should include your mortgage loan, student loans, credit card payments, car loan, and any similar debt that you’re under obligation to pay on a regular basis. Your credit report doesn’t tell the lender how much you earn, so the lender will usually want some proof of your current income.

Although the DTI ratio is not used to calculate your credit score it has a huge impact on your ability to get credit or your “creditworthiness”. When you apply for credit the lender will carefully examine your DTI ratio as it’s an excellent indicator of your ability to repay your debts. The outcome of this could either be refusal to give you credit or higher interest rates depending on the level of risk that the calculated ratio indicates.

Get Started With a Free Debt Analysis

We make it easy on mobile or desktop. FREE with no obligations.

If your DTI ratio is low then it’s considered very likely that you will repay your debts as it shows you have enough available income left over to do so. Correspondingly, a high ratio shows that you don’t have much available income and are likely to fall behind on payments.

Ideally your DTI ratio should be less than 36 percent. Lenders in general require people borrowing for a mortgage to have no higher than 40 percent in order to qualify. A DTI ratio higher than 36 percent puts you at risk of much higher interest rates or being turned down altogether for your loan.

There are a few exceptions to this rule when it comes to mortgages. The Federal Housing Authority and the Veteran’s Administration will allow DTI ratios in excess of 40 percent. Though obviously, the lower the ratio the lower the interest rate.

If you do have a DTI ratio that is too high there are steps you can take to lower it. Obviously you need to either increase your income or lower your monthly debts. This could be achieved by getting a second job or a nice raise or by finding an alternative means of earning money, such as a small side business. You can lower monthly debt payments by fully paying them off on your own or opting for a Debt Management Plan from a reputable non-profit credit counseling agency. A Debt Management Plan can help you pay off debt as quickly as possible, and save you hundreds or thousands of dollars in interest payments.

If you need help calculating your Debt to Income Ratio give Advantage CCS a call today. We offer free and confidential credit counseling and we’ll let you know what your current DTI ratio is and ways you can improve it.