The majority of bankruptcies filed within the United States are either Chapter 13 or Chapter 7 bankruptcy cases. Do you know the difference between the two of them? It’s very important to know the difference if you’ve ever considered filing for bankruptcy. To find out whether a Chapter 13 or Chapter 7 bankruptcy would be better for you, one must look at their income, assets, debts, and their future financial goals.

Filing for bankruptcy is not an easy decision, and it should be taken very seriously. You should find out if bankruptcy is your only option. Check into Debt Management Plans, Debt Consolidation Loans, maybe even Debt Settlement, before just jumping into bankruptcy without knowing the consequences. Bankruptcy can have a devastating effect on your credit score, future ability to apply for and receive credit/loans, and many other negative side effects. Talk with a certified credit counselor from a reputable Non-Profit Credit Counseling Agency first to see if there are any other options available to you.

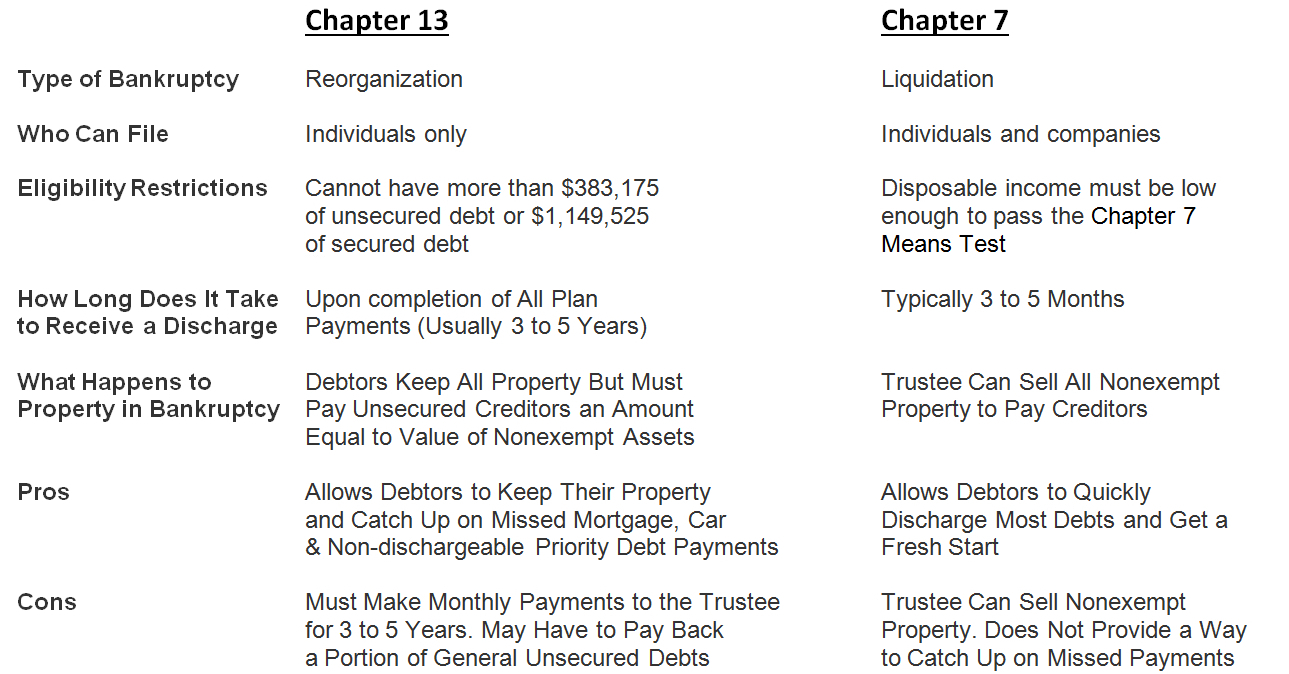

Here are the Main Differences between Chapter 13 and Chapter 7 Bankruptcy:

There are similarities and differences depending on which Chapter of Bankruptcy you file under. Some people may try to file under Chapter 7 because it seems like the best deal, but often they are rejected and must file under Chapter 13. If you are thinking about filing for bankruptcy then it’s important to understand the rules, regulations, guidelines, and standards for each type of bankruptcy.

Talk to a bankruptcy attorney about any questions you may have. Sometimes bankruptcy attorneys will refer you to credit counseling agencies to see if they can help you first. If the credit counseling agency is not able to help you, due to your unique circumstances, they can usually still help you with obtaining your pre-filing and pre-discharge certificates that are required by law, if and when you file. If you decide to file for bankruptcy then you’ll need to take certain classes or credit counseling sessions to obtain said certificates. Advantage Credit Counseling Service offers both Pre-Filing and Pre-Discharge Bankruptcy Certificates.

Get Started With a Free Debt Analysis

We make it easy on mobile or desktop. FREE with no obligations.

If you have any questions about bankruptcy or you are considering filing for bankruptcy, give us a call first. The phone call is free and confidential.