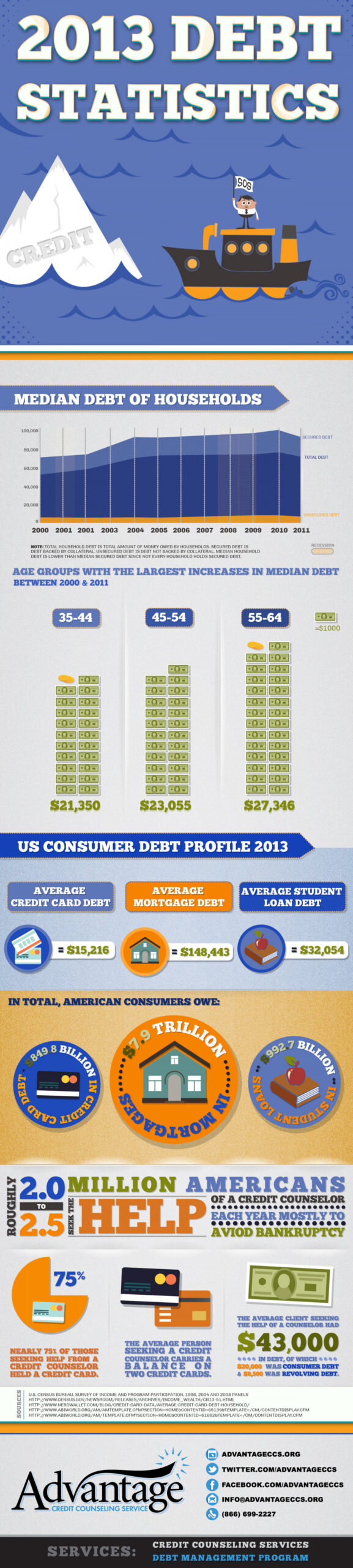

Over the past decade or so, debt has been a growing problem for families all across the country. While American consumers collectively owe almost $850 billion in unsecured credit card debt, the average American household credit card debt stands at over $15,000 per family. Other types of debt, including secured debt such as mortgages and student loans, quickly inflate the numbers and lead millions of Americans every year to actively seek debt relief options to avoid bankruptcy.

Here’s a breakdown of the latest debt statistics for households, consumers, types of debt, and more. For more information about debt as well as strategies to get out of debt and even online consumer credit counseling sessions, visit https://www.advantageccs.org. Thank you!

2013 Debt Statistics for US Consumers