The Most Innovative Online Credit Counseling Tool

Find out what your options are for getting out of debt. Over 50 years of non-profit experience.

Accredited By:

We Can Help You Get Out of Debt

Our credit counseling services are free and confidential.

- 50Years of Service

- $1.2Billion Debt Eliminated

- 400k+Clients Counseled

- A+Rating With BBB

The Benefits of Online Credit Counseling

With over 50 years of non-profit credit counseling experience, we’ve helped over 400,000 consumers become debt-free! Our outstanding customer service, A+ rating with the Better Business Bureau, and exceptional standing in the industry have all stayed the same since 1968. We’re also members of the National Foundation for Credit Counseling (NFCC).

100% FREE With No Obligations

Online Counseling 24/7

Secure & Confidential

Reviewed by Certified Counselors

Why Choose Our System Over Others?

Easy & Intuitive

Easy & intuitive step-by-step process guides you through creating a budget to get you back on track.

Personal Action Plan

We create a personalized 20+ page Action Plan with strategies for getting out of debt that relate to your specific situation.

Create a New Budget

Create and experiment with a new budget and spending strategies in order to design a payment plan that works for you.

Desktop & Mobile

The system is designed to work regardless of your device. Create a new budget at home or on a mobile device when you’re on the go.

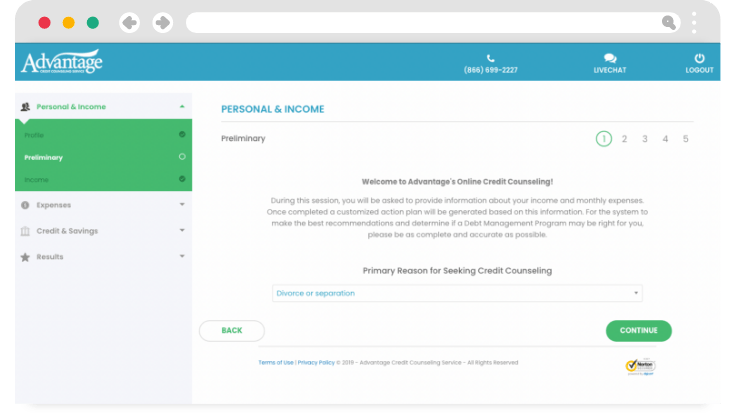

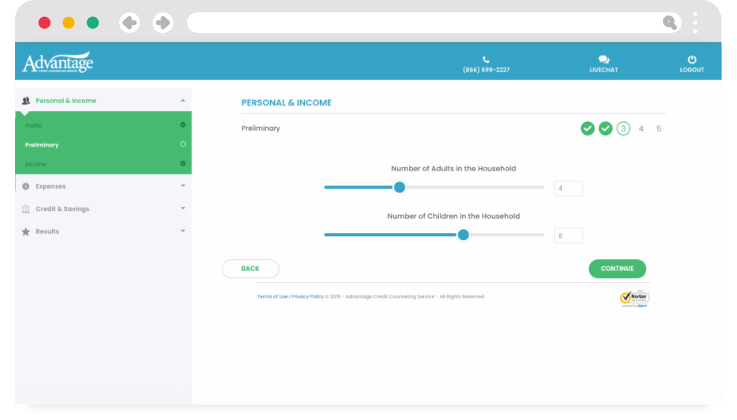

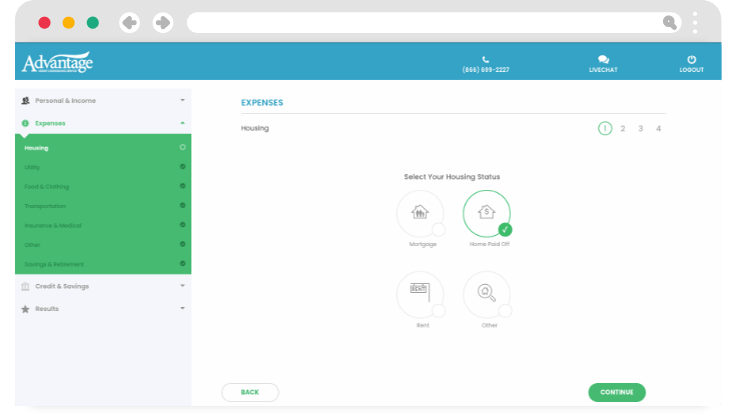

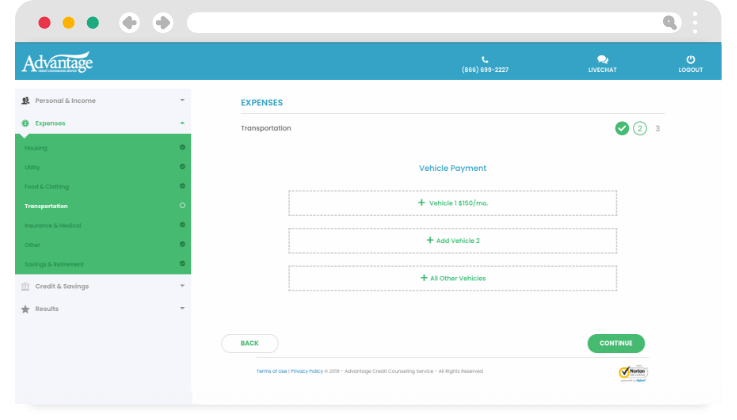

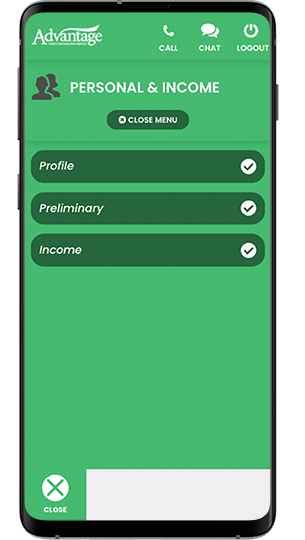

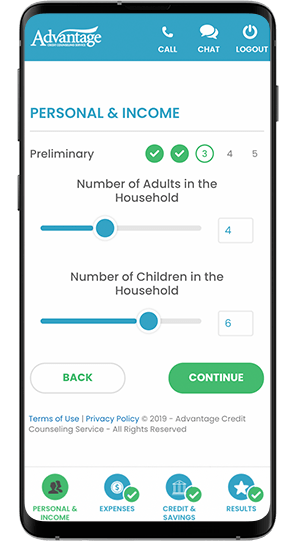

Intuitive Step-by-Step Process

Our system makes entering your information and building a budget fast and easy. It’s mobile-friendly so you can complete your session on the go.

We Break It Down for You

A custom Action Plan that summarizes your budget, gives you debt relief suggestions, and includes helpful resource links will be provided.

See How Much You Can Save

Once your session is complete, the counselor will provide you with how much money and time you can save on our program.

NOTE: Unlike other online credit counseling systems, Advantage does not require your Social Security Number, Credit Card Account Numbers, or require you to pull a Credit Report.

Ready to Get Started?

Use our FREE online system and see whether a debt management program (DMP) is right for you!

Already Signed Up? Return to your Session

Free Debt & Credit Counseling Services Online

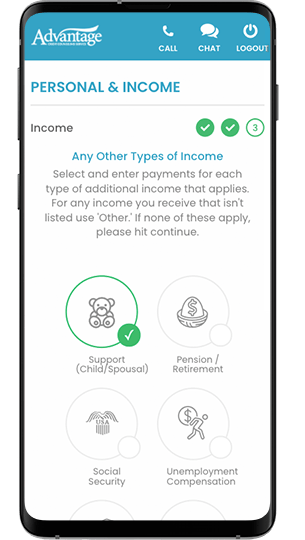

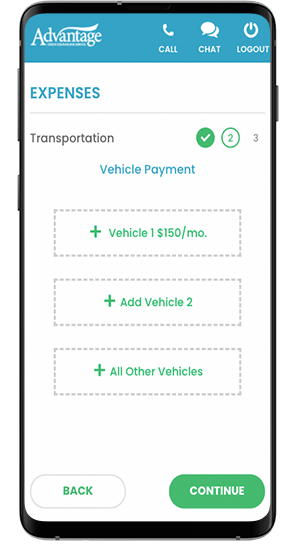

This proprietary online credit counseling system will guide you through step by step to complete the intake forms necessary for our system to analyze your complete financial situation. You will be asked to enter information such as your contact info, income, monthly expenses, and credit card debt.

We Give You More

After your current budget has been created you’ll be able to receive a customized Action Plan. This 20 plus page PDF document contains a full budget analysis, balance sheet, and personal debt reduction recommendations, tips, suggestions, and helpful resource links.

We Can Help You Balance Your Budget

Suppose the system determines that you have a shortfall, (expenses are greater than income). In that case, you can always go back and review your income and expenses, in order to see if there are any adjustments you are able to make to help balance your budget.

After Completing Your Online Session

We Make Your Options Clear

Once this is complete, the system will analyze the information you have provided and recommend whether a debt management program may be right for you. If the system determines that a DMP is the right option, a counselor will review your information and provide a comparison of your current creditor payment obligations versus an estimate of what your new monthly payment would be on our program.

We Take a Hands-On Approach

If a debt management program is right for you, one of our certified counselors will contact you within one business day to schedule a brief, no-obligation, follow-up telephone session. The purpose of this session is to ensure that all of the information you have provided is accurate and explain the details of how the debt management program works.

We will explain your options and help you decide if a debt management program is appropriate for your current situation. Additionally, we will explain the steps needed to begin the program and see if there are any other opportunities for saving you money or reducing the time it will take you to become debt free.

We Show You How Much You Can Save

Our credit counselors will present you with a clear explanation of how we can help save you money or time. We will show you:

- Your new estimated monthly payment

- How Long it Will Take to Get Out of Debt

- The Total Interest You Will be Paying

- The Total Amount You Will Need to Pay Off Your Debt

Getting Started

Our credit counseling services are free and confidential.

- Get Started by Creating a Free Account

- Input Your Monthly Expenses & Debts

- Review Your Budget Analysis

- Evaluate Your Options & Your Action Plan

Becoming Debt Free Starts Here

If you’re struggling to make ends meet, our team of certified counselors are waiting to help you find a solution that’s right for you. No matter what your financial situation may be, remember you’re not alone.

What Our Customers Are Saying

With much relief I wish to inform you that all creditors have been paid in full! Thank you for your direction and support during some very difficult times. I would certainly refer you to anyone who needs financial direction. Janet , Pittsburgh, PA

I was and am still a faithful believer in ACCS and will recommend those that I come in contact with. Thank you for being there for me. It did give me piece of mind and you gave me respect and treated me as a human being. Todd, San Francisco, CA

Just a small token of thanks to you and Advantage CCS for your professional, efficient and courteous service. Heather, Albany, NY