The Holiday season is knocking on the doors, and indeed, people cannot stop thinking of how much they will spend on gifts and fun activities. Like with other holidays witnessed in recent years, this Christmas season will be a shopping and spending spree for many. However, the shopping frenzy has both benefits and a few […]

Continue ReadingTag: credit card debt

What Happens When Your Credit Card Deferment Has Ended?

With the Coronavirus pandemic wreaking havoc on the US business community and elected leaders requiring some businesses to close, credit cards are being used by consumers and business owners as one of several financial buffers to get through these tough times. Unfortunately, this has created a dilemma for anyone facing credit card debt, or those […]

Continue ReadingHow To Handle That Old Debt

Dealing with old debt is a nuisance for most people who’ve likely moved on with their lives or even forgotten about the debt completely. But, as they say, old things come back to haunt us. You’ll find a bit of relief, however, because it’s much easier to handle older debts than new. With the right […]

Continue ReadingIs Non-Profit Debt Consolidation Right For You?

There can come a point where credit card debt can build up to levels that become overwhelming and too much for people to deal with. Maybe they’re already getting collection calls or getting mail that has bad news of what could happen if they don’t start paying up. When this starts happening, there are usually […]

Continue ReadingAdvantage CCS Teams Up with CardRates.com to Talk About Free Consumer Credit Counseling

Our very own Heather Murray, Manager of Regulatory Compliance and Education, recently spoke with Ashley Dull who is the Editor-in-Chief at www.CardRates.com about our holistic approach to tackling credit card debt and what our free consumer credit counseling can do to help people who are struggling with unsecured debt such as credit cards and medical […]

Continue ReadingMarvelous Money Tips for Newlyweds

After the cake has been eaten, all the champagne has been drunk, and all of the smiling guests have gone home from your extravagant wedding reception, it can be difficult for newlyweds to switch gears into real life again. It can sometimes be a challenge to change your mindset from “money is no object – […]

Continue ReadingThe Scary Reality of Being in Debt

Consumer credit card debt and student loan debt are at an all-time high right now, and it’s pretty safe to say that almost everyone has to deal with the pitfalls of debt in one way or another. The strange thing about debt is that it’s an excellent teacher, and it’s also one of the best […]

Continue Reading10 Steps to Eliminate Credit Card Debt

People always ask me this same question: “How can I get rid of my credit card debt as quickly as possible”. And the answer is always: “You didn’t get into debt overnight, and you most certainly won’t get out of debt overnight either. Work hard on it, be patient, and start now!” I’m going to […]

Continue ReadingWhat is the best debt to credit ratio?

We get asked this question a lot by our current clients and potential clients: “What is the best debt to credit ratio?” First, we must explain what a debt to credit ratio is. To put it in layman’s terms, it is how much you owe versus your total available credit limit. A debt to credit […]

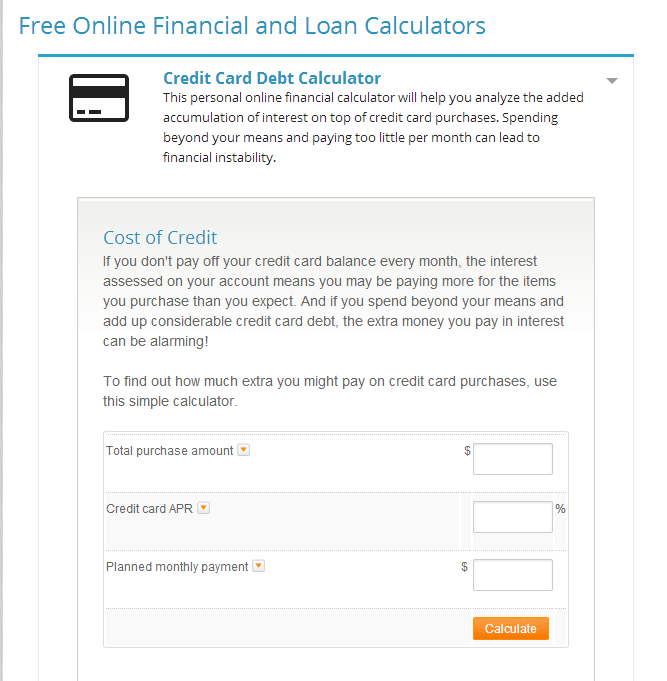

Continue ReadingCredit Card Debt Calculator and How to Pay Off Debt

You can always count on interest accumulating if you carry a balance every month on your credit cards. Sure, you may still have a month or two of “free interest” left on that credit card you signed up for, but when that promotion ends, what happens then? You get hit with some charges and fees […]

Continue Reading